Introduction

Historically, portfolio managers have been divided between two investment approaches: Active Investing or Passive Investing. The debate about which one is better is still ongoing, with no end in sight. This topic is more than just an academic discussion because it has the potential to have a significant impact on your portfolio’s outcome. With the advances in quantitative finance and computational power, a new investment approach has recently emerged in popularity: Factor Investing.

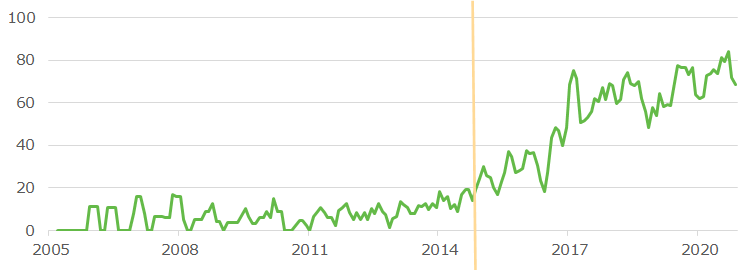

Factor Investing Keyword Search on Google Worldwide

As shown above, the search for the keyword “Factor Investing” has surged since 2015. This new alternative, built as a hybrid of the two previous investment approaches, has become more broadly studied and adopted by portfolio managers. It has also been gaining further acceptance as its performance attracts more investors. This article will discuss each investment approach’s merits and pitfalls and explain why Factor Investing should have a place in your portfolio.

Active Investing

Active Investing has a goal to outperform the market by owning a concentrated portfolio of stocks. It is a hands-on approach requiring extensive expertise in analyzing and valuing investments. Typically, a portfolio manager oversees the mandate and is usually assisted by a team of analysts.

Since this discretionary implementation relies on continuous monitoring and portfolio rebalancing, higher brokerage, management and performance fees are expected, which all decrease the net portfolio return. Beating the benchmark is uncertain and exposes the portfolio to a higher tracking error.

The higher trading frequency gives more control over the portfolio, which provides downside protection when markets are falling. This also allows the portfolio manager to build an investment strategy which better reflects the needs of the investor, with the potential to maximize tax efficiency.

Passive Investing

Passive Investing is at the opposite end of the spectrum: the main objective is to achieve a return in-line with the market. Wealth is built gradually through a buy-and-hold strategy of stocks mimicking an index, making it a cost-effective way to invest. As a result, the trading activity is then minimized.

By trying to replicate the market performance, passive portfolios are well-diversified, and since no research is required in the investment process, management fees are lower. Also, Passive Investing does not result in significant capital gains each year, making them very tax-efficient.

Robo-advisors offer Passive Investing for a fraction of what active fund managers charge. Hence, those investors face no minimum requirement to own a passive portfolio. They do, however, have less control over the portfolio and can’t adjust the holdings if some sectors or companies underperform.

Factor Investing

Simply put, a factor is a common characteristic related to a stock explaining its return. There are two types of factors: financial (i.e. quality, value, momentum, etc.), and non-financial (i.e. environmental, social, governance, etc.). To learn more about the different factors, visit our page on the subject.

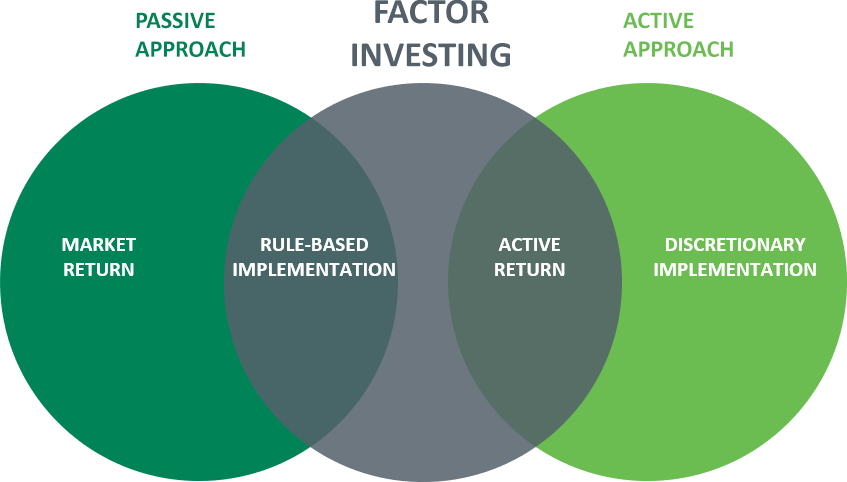

Factor Investing is considered a merger between Active Investing and Passive Investing. Portfolio managers are considered active investors as they buy stocks with similar factor exposure. They will also sell stocks that don’t meet their criteria for a specific factor exposure. Nonetheless, it still is a systematic, disciplined, and rule-based investment approach, similar to Passive Investing.

Active Return

The primary goal is to outperform the market by investing in a specific well-chosen set of factors within a concentrated portfolio. The approach requires expertise in selecting robust factors and building a ranking system to sort each stock within its investment universe. Portfolio construction is key to defining the investment rules, as a lot of the quantitative work is done by crunching factors from a database.

Transparency

Factor Investing offers transparency in executing the investment strategy by clearly defining the desired factor exposure beforehand. Portfolio managers are always able to understand what is driving their portfolio’s return without being influenced by their own emotions or opinions.

Control

Each factor performs differently throughout an economic cycle. A multi-factor approach helps diversify the risk of being exposed to a single factor at the wrong time. Adjusting the factor exposure allows for a more efficient portfolio with better risk-adjusted returns than the traditional approaches.

Cost and Tax efficiency

Single-factor strategies are inexpensive, with management fees slightly above Passive Investing. Multi-factor strategies including a human overlay, are usually cheaper than active fund managers. The tax efficiency can be high if the metrics chosen to represent each factor have a low portfolio turnover.

Final Thoughts

We believe the best investment strategy is achieved by combining active and passive strategies, which is the foundation of Factor Investing. It allows an investor to earn an active return (Active Investing) while using a systematic, rule-based implementation approach (Passive Investing).

Although past performance is not a guarantee of future returns, many factors have proven to be persistent drivers of returns across multiple markets over time. This new approach also offers investors full transparency and control over their risk appetite in a reasonable, cost-effective manner.

SOLWealth will provide you with the benefits of Factor Investing today:

- You can invest in one or more of our multi-factor ESG strategies that typically address specific objectives within a reasonably low management fee structure.

- You can use our turn-key portfolios to replace what your current investment advisor or robo-advisor is offering and increase your portfolio’s outperformance.