Investors are increasingly interested in integrating Environmental, Social, and Governance (ESG) factors into their investment philosophy and process. Last year, global sustainability and climate change issues were brought to the forefront of attention. The COVID-19 pandemic showed that companies with superior ESG measures were better prepared to weather this crisis.

Portfolio managers engaging in that practice have to make sure they will invest their clients’ money in responsible companies. They will assess non-financial factors such as Environmental, Social, and Governance in making their investment decisions. For more information on the metrics used for each of those factors, please visit our website’s ESG page.

This article will review the pros and cons of ESG Investing and explain why this investment approach should have a place in your portfolio and help meet your financial needs.

Pros

Higher Return

It is often assumed that ESG Investing underperforms. This misconception is wrong because history has proven that there is no trade-off in aligning value and values. Over the last five years, ESG indices have outperformed their non-sustainable counterparts, as shown below:

| Returns | 1-Year | 3-Year | 5-Year |

| S&P 500 | 31.3% | 14.1% | 16.8% |

| S&P 500 ESG | 32.2% | 15.3% | 17.4% |

| MSCI Canada | 20.2% | 8.4% | 11.5% |

| MSCI Canada ESG | 27.4% | 9.4% | 13.0% |

Source: S&P Global and SOLWealth

Companies with high ESG ratings tend to have a competitive advantage, allowing them to create value for their shareholders. These conscientious efforts to adhere to the highest standards are reflected in their higher profitability and dividend yield relative to their peers.

Lower Risk

Personal satisfaction comes from investing in the right place for the right reasons. Investors like the idea that as ESG practices are implemented, value is created across the company’s activities. Investing in responsible companies also come with risk mitigation benefits:

- Lower specific risk: Companies with high ESG ratings are less prone to major unexpected incidents due to superior planning that would cause a significant price drawdown.

- Lower systematic risk: Companies with high ESG ratings have less price and earnings volatility as best practices lower uncertainties, and investors award a premium.

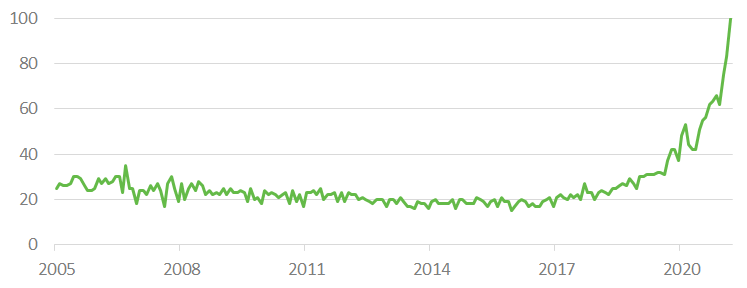

Growing Popularity

ESG Investing has been on the rise in the last couple of years, just like Factor Investing, and has recently reached its highest level of interest. This translates into inflows to “greener” companies by attracting more customers to their sustainable products and services.

Source: Google Trends

Some analysts consider ESG Investing a fad. It doesn’t seem to be the case, mainly because more people demand businesses to be transparent and accountable in their ESG practices. Social and Environmental issues, like cultural diversity and global warming, are becoming more prevalent. Institutional investors are also tackling Governance issues by proxy voting more often. All these trends accelerate the presence of ESG Investing in the investment community.

Cons

Lack of Diversity

The significant drawback of ESG Investing comes from the lack of diversity in the stock selection. Most companies ticking all the boxes are large-cap stocks, which limit the potential of solid diversification. As a result, investors may find that their portfolios have lower exposure to small-cap or mid-cap stocks. However, this is changing because financial research companies offering ESG ratings are expanding their ESG capabilities with broader stock coverage.

Sector Exclusion

Some industries are often excluded from the ESG investment universe. The offenders are usually thermal coal, oil & gas, tobacco, and weapons. By avoiding these industries, investors might miss on potential opportunities. For example, oil & gas stocks outperform when rates and inflation increase; also, tobacco stocks are known to be defensive during a bear market. This exclusion may result in portfolios with a higher concentration in some sectors.

Final Thoughts

ESG standards are guiding how companies operate and interact with their stakeholders. ESG Investing has proven to add value for investors through better relative market performance while minimizing risks. However, responsible investing comes with a few caveats: lower diversification and sector exclusion are constraints in the investment process that might lead to factor tilts and may require additional exposure management.

This approach is becoming an essential part of investors’ choices and views. Be a leader, follow your convictions by investing with us today and reap the benefits. We offer insightful expertise in stock picking responsible companies with strong potential. SOLWealth provides you with unique investment solutions combining Factor and ESG Investing:

- Invest in any of our four multi-factor ESG strategies with well-defined objectives and competitive management fees relative to the performance they provide;

- Use our turn-key portfolios to replace or compete with your current investment advisor or robo-advisor’s offering and increase your portfolio’s risk-adjusted returns.